Monthly News Letter | June

Financial Markets Stabilize & Retailers Highlight Inflation’s Impact

Monthly Market Summary

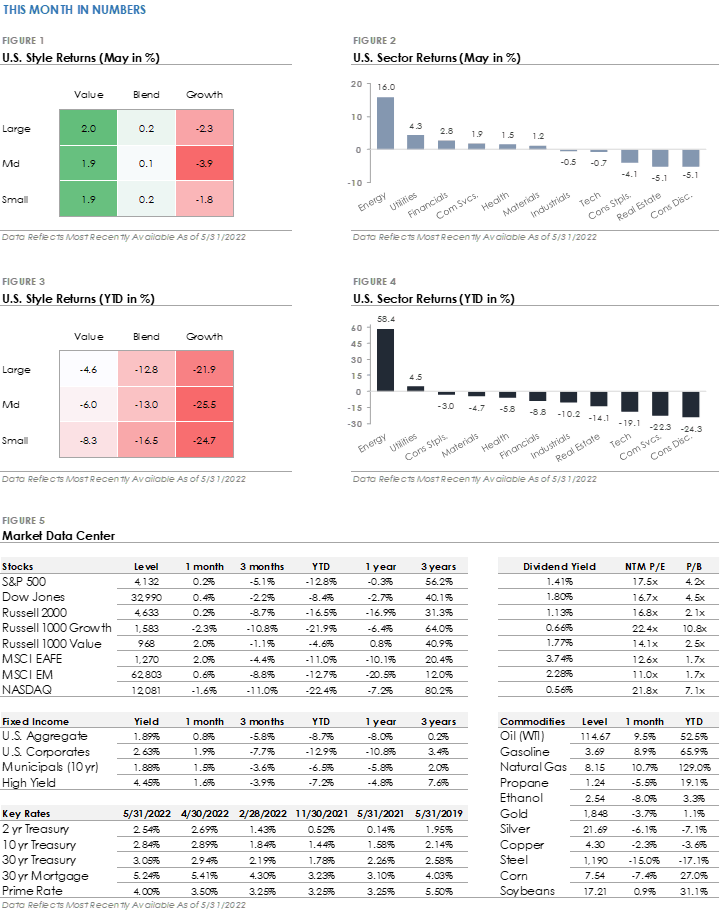

- The S&P 500 Index produced a +0.2% total return during May, in line with the Russell 2000 Index’s +0.2% total return.

- Energy was the top performing S&P 500 sector during May, returning +16% as the price of WTI Oil rose +9.5%. Consumer Discretionary was the worst performing sector, returning -5.1% as Amazon and Tesla both traded lower. Consumer Staples was the third-worst performing sector, returning -4.1% as weak earnings weighed on retail stocks (refer to comments below).

- Corporate investment grade bonds generated a +1.9% total return, slightly outperforming corporate high yield bonds’ +1.6% total return.

- The MSCI EAFE Index of global developed market stocks returned +2% during May, outperforming the MSCI Emerging Market Index’s +0.6% return.

Equity & Credit Markets Stabilize After April’s Selloff

The S&P 500 was flat during May. While the +0.2% return was a welcome sight after April’s -8.8% decline, the S&P 500’s daily price movements remained volatile with the index down more than -5% at its lowest point. In the credit markets, corporate bonds produced positive total returns as Treasury yields stabilized.

Looking at the big picture, Federal Reserve policy and inflation remain top of mind for investors. The Federal Reserve raised its benchmark interest rate +0.50% at May’s meeting and is expected to follow-up with +0.50% increases at both the June and July meetings. Separately, data showed inflation accelerated +8.3% year-over-year during April 2022 and remains near a 40-year high. The Federal Reserve wants to see evidence inflation pressures are easing, which leaves investors debating how far and fast the central bank will increase interest rates to combat high inflation. The near-term investment outlook remains particularly uncertain as the market searches for direction.

Retailer Earnings Underscore Inflation’s Impact on Businesses & Consumers

Walmart and Target both reported underwhelming first-quarter 2022 earnings. Both retailers were caught flat-footed by not raising prices fast enough in response to increased supply chain costs. The two retailers also saw their inventories grow by +30%, reflecting price increases by their vendors but also softening consumer demand for discretionary purchases, such as home goods and apparel. Walmart’s CEO said, “… the rate of inflation in food pulled more dollars away from GM [general merchandise] than we expected as customers needed to pay for the inflation in food.” Looking ahead, the two retailers signaled the potential for additional price increases. Target’s CEO said, “… you should expect us to surgically pass along costs where appropriate.”

The earnings reports caused retail stocks to selloff and highlighted three key themes. First, inflation pressures are strong and catching companies off-guard. Walmart revised its forecasted earnings lower, while Target did not provide an update. Second, inventories ballooned after the retailers restocked at higher prices and consumers shifted spending due to rising prices. It could take multiple quarters to work through the excess inventories. Third, additional price increases may be coming as companies focus on maintaining profit margins. The three themes demonstrate inflation’s worrying impact, which our team will continue to monitor.

Source: Marketdesk Research LLC. Financial planning and investment advisory services offered through Financial Resources Group, LLC, a registered investment advisor. For more disclosure information go to www.frplan.com.

BROWSE OUR WEBSITE

CONTACT INFORMATION

Phone: 860-657-8380

Fax: (860) 657-9535

Address: 116 Oak Street, 2nd Floor

Glastonbury, CT 06033

Copyright © Financial Resources Group, LLC All Rights Reserved.

*Financial Planning and Advisory Services offered through Financial Resources Group, LLC, a registered investment advisor.

Insurance products and services are offered and sold through individually licensed and appointed agents in all appropriate jurisdictions.